Tariffs and Family Office Investing

Market uncertainty triggered by the Trump administration's inconsistent tariff policies has sent ripples across the investment landscape, and family offices are not immune.

Fortune recently reported that, while it appeared U.S. family offices (FOs) were committed to partaking in ever-more complex investment deals in recent years, “Trump’s tariffs could put that [strategy] on pause.”

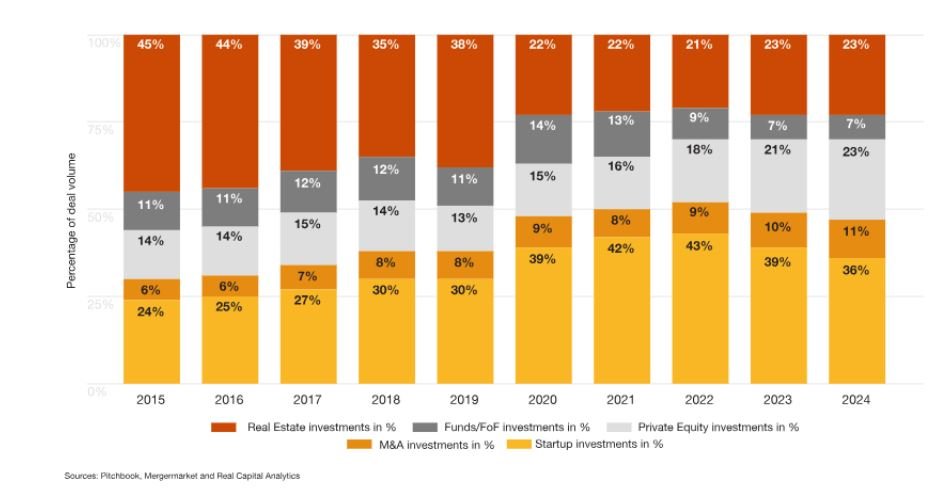

These ever-more complex deals hinged on FOs shifting away from more mainstream investment bets, such as real estate and traditional funds, in favor of alternative opportunities. Pitchbook’s data confirms this, showing that over the last ten years, many U.S.-based FOs have flipped the script, migrating from more tried-and-true strategies to new opportunities in startups, M&A, and private equity.

At least that was the pattern before the Trump tariff policies sent markets reeling.

Now, according to PwC, such deals have slowed down in 2025 “as wealthy investors and financial institutions around the world take a wait-and-see approach to Trump’s tariff policies.”

One PwC family office specialist told Fortune that “activity all but came to a standstill in the first quarter [of 2025],” adding that it is “unlikely that the cadence will pick up enough throughout the rest of the year to beat last year’s activity, even if Trump backs off completely.”

This marks a startling about-face from the direction PwC once envisioned family offices would follow, says Fortune. “Going into 2025, [the firm expected both [FO] deal value and deal volume would be higher than last year, given easing inflation, potentially lower interest rates, and rising consumer and executive confidence. Now all three of those elements are in doubt.”

Family Offices and Post-Boomer Investors

PwC wasn’t alone in predicting a big year for family offices. Avestix also began 2025 with the release of The State of Play for Family Offices, an eBook that examined how family offices might be ideal custodians of the coming “great wealth transfer.”

Where “many of the large banks and financial services organizations [are] competing to serve as custodians to the coming wave of wealth,” we predicted that, because most of these institutions are highly cumbersome and reliant on legacy technologies, younger high-net worth investors would gravitate to FOs, which are more lean and agile and can “quickly adapt to changing investor values and priorities.”

Changing priorities include the growing trend among many family offices to invest in alternative assets such as crypto and blockchain projects, as well as startups leveraging green technologies. As we explained in the eBook, while more modern investments may not resonate with baby boomers, data shows that Gen X, Millennial, Gen Z and Gen Alpha investors are embracing alternative investments, seeing them as potential opportunities for growth.

Could Trump’s unruly tariff policies get in the way of the efforts of family offices to connect with post-boomer investors?

“Tariff headwinds could likely temporarily curtail the appetites of family offices to fund new startups and new technologies,” says Susan Lindeque, CEO and Founder of Avestix. “But we expect to see a more measured approach and greater due diligence across the entire investing landscape in the coming months.”

However, she says, in the long run, family offices may benefit from the tariff turmoil.

“Even in the best market conditions, sixty percent of high-net-worth investors say they prefer to work with financial advisors, " she says. “These are the very investors that family offices cater to. Given the amount of market turbulence we’re now seeing, wealthy investors — even those who have shunned family offices in the past — may now consider enlisting their guidance.”

Need Help Navigating Today’s Investment Climate?

Are family offices right for you? Download The State of Play for Family Offices to learn more.

Or contact Avestix with your investment questions.

All investments involve risk and some investments and investment sectors discussed may not be suitable for all investors. Please consult your financial advisor before making any investment decisions.