Stablecoins are Gaining Traction

The popularity of stablecoins — digital currencies tied to reliable assets such as the U.S. dollar or other fiat currencies — is booming.

Cointelegraph recently reported that the number of stablecoin users has grown from less than 20 million in early 2024 to more than 30 million this year.

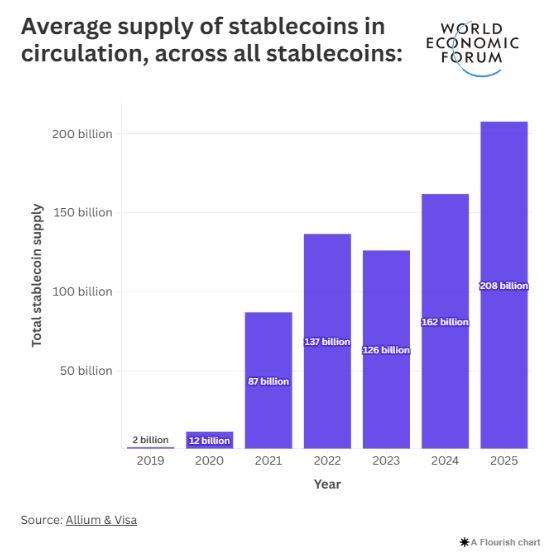

But the crypto press is not the only one noting the exploding popularity of stablecoins. The World Economic Forum (WEF) recently analyzed the climb in stablecoins over the last ten years and mapped out their mainstream use. As the WEF noted, stablecoins are “increasingly bridging the divide between traditional banking systems and the world of cryptocurrencies.”

In 2019, there were two billion stablecoins in circulation. That number swelled to 12 billion within a year, but that growth spurt was only the beginning. According to the WEF, the number of stablecoins now in circulation exceeds 200 billion. Last year, stablecoins were used in $27 trillion transactions, “surpassing the combined volume of Visa and Mastercard [purchases] in 2024.”

These figures correspond to findings included in another recently released report, The State of Stablecoins 2025 by Dune & Artemis, which confirmed 91 percent of stablecoins are now fiat-backed (up from 90 percent a year ago), “reflecting growing trust in fully collateralized [stablecoin] models.”

The appeal of stablecoins pegged to mainstream monies is reinforced by the report’s other finding that less than 9 percent of the coins in circulation are backed by “overcollateralized crypto assets, such as ETH and staked assets.” Meanwhile, algorithmic stablecoins are losing market share, “reflecting reduced confidence in uncollateralized or partially collateralized models after past failures.”

As Dune & Artemis suggest, these findings indicate investors have a clear “preference for stablecoins with stronger collateral frameworks, particularly as regulatory scrutiny intensifies.”

Mainstream Adoption

Susan Lindeque, CEO of Avestix, says it’s important to remember that, despite their growing popularity, stablecoins — even those pegged to mainstream currencies — represent only a small fraction of the overall currency landscape.

But, she says, that mainstream adoption isn’t far away.

“Market demand will make stablecoins a necessity,” she says. “Their speed and efficiency already surpass other financial instruments, especially when making cross-border payments. Stablecoins can be moved 24/7, while traditional payments can take days to settle. Once financial institutions, merchants and consumers become more comfortable with stablecoins, their usage will only become commonplace.”

Indeed, according to Chainalysis, stablecoins now account for a notable share of payments and peer-to-peer transactions. “Their ability to process transactions quickly and cost-effectively, often with minimal fees compared to traditional banking systems, makes them an attractive option for users. … [Stablecoins] provide a simple and secure way for individuals to exchange value without intermediaries. This is particularly valuable in regions with limited access to reliable banking systems.”

Lindeque says the use of stablecoins in cross-border payments represents something of a test case for their viability.

“The Chainalysis data shows that many unbanked migrant workers now use stablecoins to transact and share money with family members because those transactions are not only faster, but they are cheaper compared to the costs of sending funds using traditional channels,” she says.

She believes this preference will help force traditional banks to begin exploring stablecoin payment options, which will drive greater financial inclusion. This, in turn, will inspire the financial services industry to demand regulatory clarification around stablecoins, she says.

“One crypto executive recently predicted the global stablecoin market will be valued at $1 trillion by the end of this year,” Lindeque says. “Imagine the growth we will see once traditional banks begin embracing stablecoins.”

Do Stablecoins Belong in Your Portfolio?

Stablecoins are just one of many cutting-edge investment opportunities younger investors are now considering.

If you hope to attract next-generation investors, you owe it to yourself to find out what they look for in investment partners.

Download The State of Play for Family Offices, 2025, a new eBook that examines the financial preferences of post-baby boomer investors.

All investments involve risk and some investments and investment sectors discussed may not be suitable for all investors. Please consult your financial advisor before making any investment decisions.